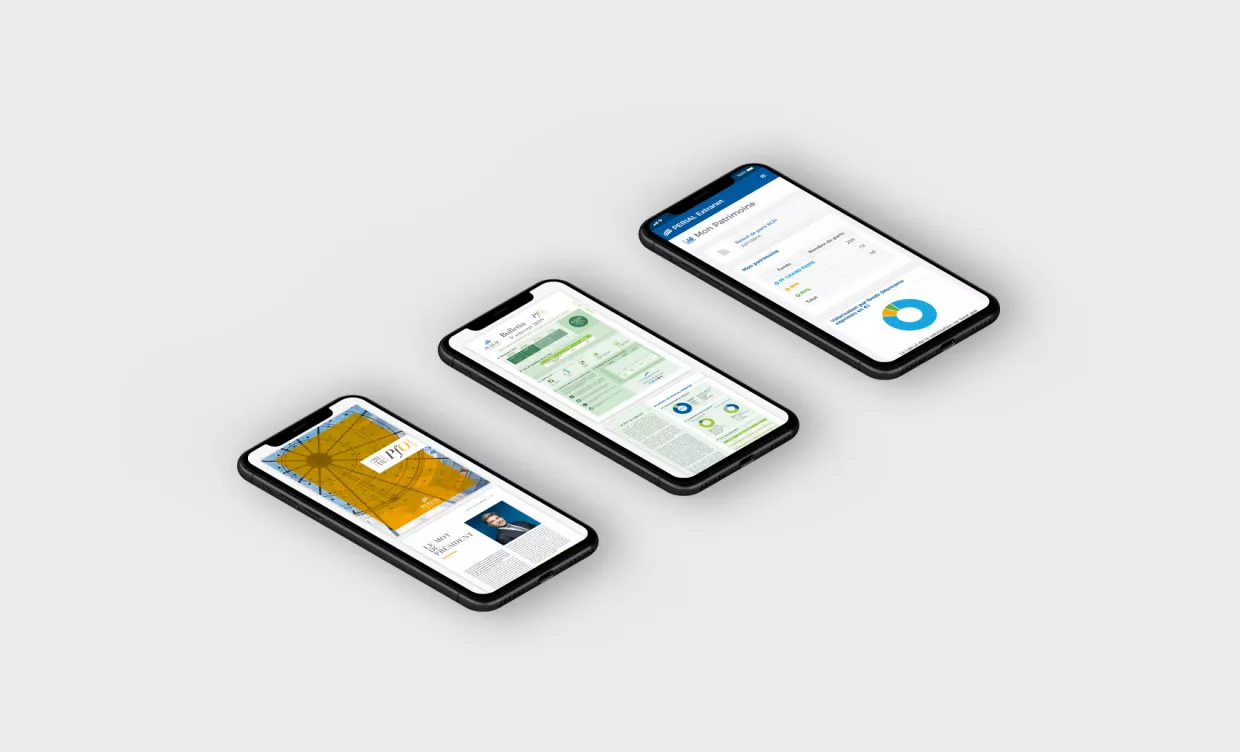

Your PERIAL Asset Management shareholder experience

Conformément à la directive 2014/65/UE relative aux Marchés d'Instruments Financiers dit "MIF", vous reconnaissez entrer dans la catégorie des investisseurs professionnels mentionnés à l'article L533-16 du code monétaire et financier, aux investisseurs avertis au sens des articles 423-49 du RGAMF et D411-1 et suivants du Code Monétaire et Financier, ainsi qu'aux investisseurs étrangers appartenant à une catégorie équivalente sur le fondement du droit du pays dont ils relèvent. Pour votre protection, avant consultation du site, nous vous conseillons de lire attentivement les informations présentes dans les "mentions légales".

Vous reconnaissez avoir lu et acceptez les modalités d'utilisation de ce site dès lors que vous vous connectez en tant qu'investisseur professionnel.

Investing in SCPI is a long-term investment with limited liquidity, capital and income not guaranteed.